The Electric Reliability Council of Texas (ERCOT) territory has seen extensive adoption of energy storage projects, with much more expected, due to the valuable project returns available and the need for greater grid resilience.

In Stem’s recent webinar, project developers looking for insights into the ERCOT storage market learned about Stem’s front-of-meter (FTM) offerings for ERCOT, including:

- FTM storage key use cases

- Stem’s developer support services and approach

- Insights about finding and quickly deploying the most valuable projects

- Ways to maximize project returns once deployed with the help of Stem’s smart storage software

The webinar was presented by Stem’s energy experts Cody Guidry, Business Development Director and Neat Clark, Product Marketing Director. The Texas natives provided their perspective on how to successfully develop large-scale energy storage projects in ERCOT.

The following is a brief summary of the webinar.

Market Trends & Opportunities in ERCOT

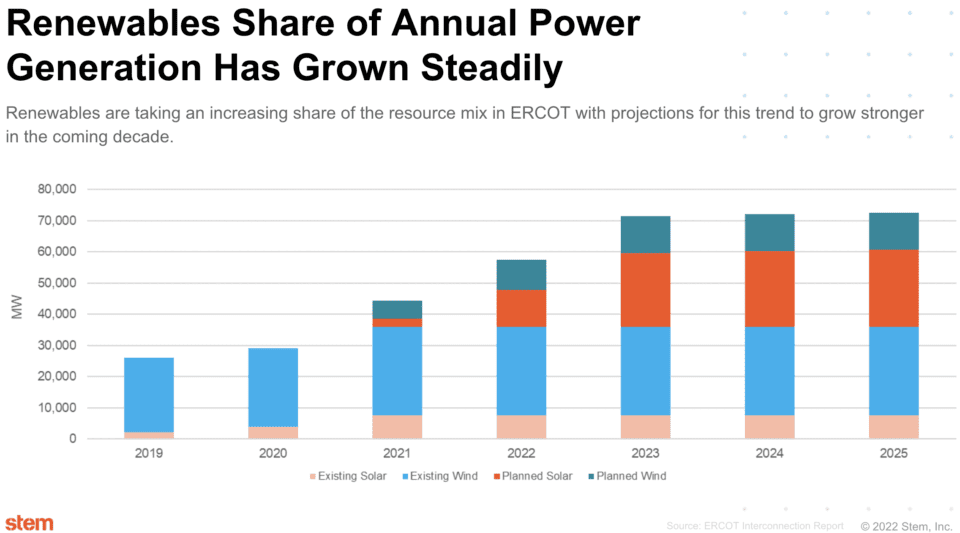

Texas has historically been a leader in renewable energy, with a focus on wind; however, current trends indicate a surge in solar power coming online. Texas is currently planning to build 10 GW of solar power in the next couple of years; compared with California’s plan of only 2.3 GW in the same period.

The below chart shows the significance of the growth of planned solar in the ERCOT market.

There’s also a surge in Standalone Storage, which currently dominates the development queue with 42 GW planned and 833 MW currently in operation. An important theme with Standalone Storage is that it’s a different outlook than what is occurring in other markets such as California or the Northeast. After decades of stagnant installation, much of this growth really started to show in 2020, and by 2021 the market had increased 107% since 2018.

Why Choose Texas?

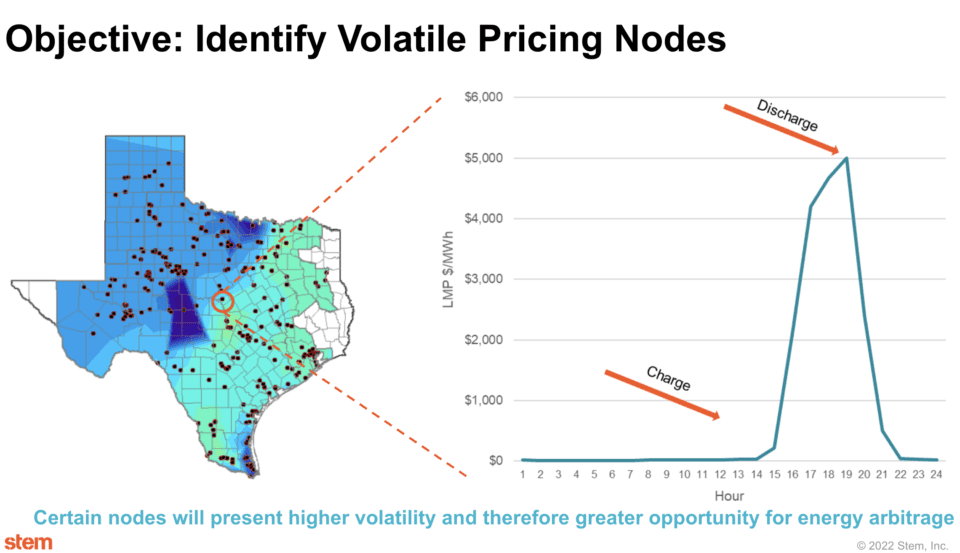

Unlike other ISOs, ERCOT doesn’t have a capacity market, and that is done by design: it creates a volatile energy market. So instead of projects being built based on long-term, contracted, off-take agreements based on capacity (which creates a baseline of project economics and returns), they are built with the expectation that there will be lucrative opportunities to sell energy at very high prices throughout the year. That creates a high-risk / high-reward environment in ERCOT.

Identifying Volatile Pricing Nodes

Energy arbitrage is when the battery is able to charge during low pricing hours and discharge at substantially higher rates, as shown in the below chart. The trick is knowing when the spike is coming, how high it will go, and being prepared to take advantage of it. This is where the importance of intelligent battery storage controls – coupled with intelligent bidding software, such as Stem’s AI-driven Athena® – comes into play.

Revenue Opportunities for Storage in the ERCOT Wholesale Electricity Market

There are two primary products in ERCOT: the energy market and the ancillary service markets. The energy market has the deepest value and relates to energy arbitrage, as discussed earlier.

The ancillary markets are made up of a number of products that balance the grid and ensure that capacity and reliability is available on a day-to-day basis. The value of these ancillary products, particularly responsive reserves, known as spinning reserves in other ISOs, are incredibly high priced right now and storage can come in and bid as a price taker.

Storage Economics & Best Practices in ERCOT

An important aspect to remember about the merchant opportunity in ERCOT is that it is much more fundamentals- and economics-driven from an energy ancillary services perspective than other markets or states, and as a fundamentals driven market with fewer value streams, there is a necessary focus on the speed-to-deployment to capture those streams while they are still around.

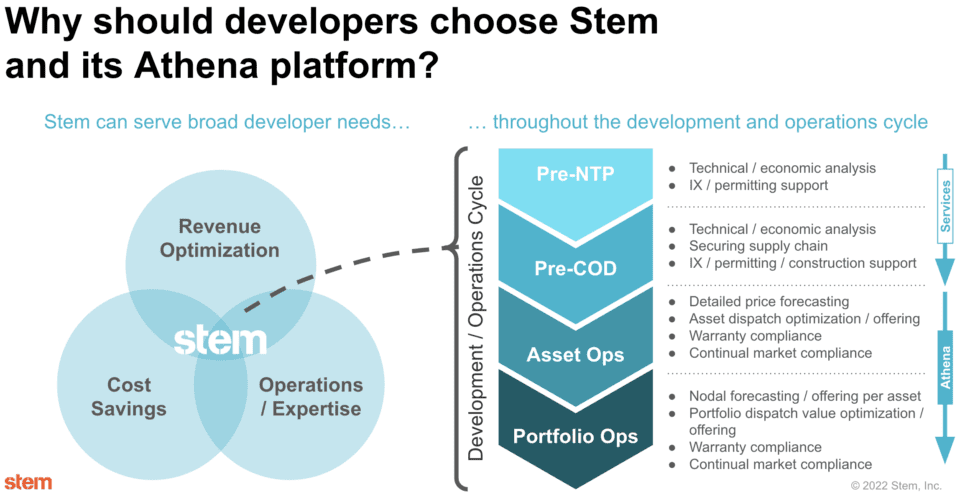

There are several upcoming market structural changes that are coming – such as shifts in the ancillary services market and the implementation of real-time co-optimization – which makes keeping up with the market a daunting task. Navigating these complexities is where Stem and the Athena platform excel.

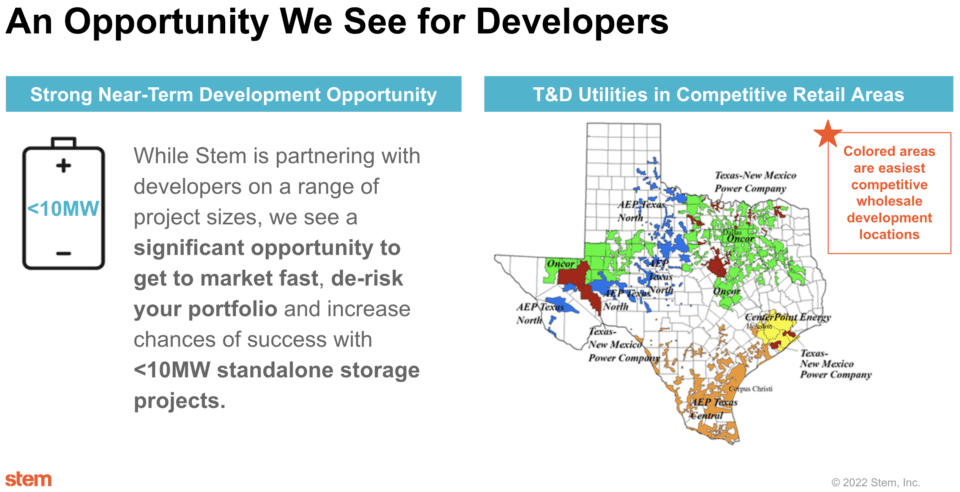

Capture Speed-to-Market with Stem

Through Stem’s experience, we know that projects with less than 10MW of standalone storage will get to market faster than other, larger systems. When building <10MW systems, developers can interact directly with a Transmission and Distribution Service Provider (TDSP), enabling them to secure an interconnection agreement in a much shorter time. This is one of the most critical, speed-enabling components of the entire opportunity.

Stem works with our partners from start to finish, helping them through complex systems and processes, and outfitting them with Athena’s advanced AI-driven software to control the hardware.

Click here to view the webinar and listen in to the Q&A.

Connect with Stem today and fill out the form below.