Stem’s recent webinar on the topic of everything electric co-ops should know about the upcoming passage of the Federal Storage Investment Tax Credit (ITC) will bring you up-to-date with not only the Build Back Better (BBB) bill, but also how a new Direct Pay option can be a game changer for co-ops and how the bill will have an impact on reducing energy storage installation costs. The three industry-leading speakers include: Chris Mathey VP, Federal Policy & Business Development at Stem; Jan Ahlen, VP, Utility Research & Policy at National Rural Utilities Cooperative Finance Corporation (CFC); and Matt Smith, Project Manager at GDS Associates.

All About the Federal Storage ITC

Chris Mathey of Stem led off the webinar with a report on how the BBB bill could potentially be passed by the end of the year. But, a number of near-term steps will be required to get it across the finish line. The House of Representatives is expected to take up the bill once they have received the official score from the Congressional Budget Office (CBO) on how the bill is paid for and whether it will add to the deficit. Once it is passed by the House it will be sent to the Senate for their consideration, where it is widely expected to be amended and revised, and then sent back to the House for their approval. While the House could amend the Senate version, most political handicappers believe they will approve the Senate version (but not without debate) and finally send it to the President for his signature.

As of November 16th, the current draft of the House version includes a Standalone Storage ITC through 2031 at 30% (it starts as a 6% base credit for projects that don’t meet prevailing wage or apprenticeship requirements). There are two additional “adders” that can increase the credit 10% each, for a maximum credit of up to 50%. The first 10% adder pertains to whether you source domestic content, which includes 100% of your cement and steel for your projects and if you domestically procure, over a several year time span, up to 55% of your manufactured products. The second 10% adder relates to siting your project in a fossil transition community—communities that have been impacted due to the closing of coal mines and coal plants. When you locate your project in a financially disadvantaged community such as this, and if you meet the domestic content requirements, then the total cost of your project can decrease by as much as 50% by electing the Standalone Storage ITC.

Direct Pay Option is a Game Changer for Electric Cooperatives

The webinar also reported on financing options for electric co-ops, including: Direct Pay (as part of the BBB bill); Tax-Equity Partnerships – Flip Financing; Direct Financing; and Power Purchase Agreements – Developer Financing. Jan Ahlen of CFC—a member-owned nonprofit cooperative that provides financial products to America’s rural electric cooperative network—went into details on each of these options during the webinar, but here is a very quick overview of how the Direct Pay option will work.

Direct Pay financing will have a significant impact on the electric co-op space within the storage area as they are tax exempt and do not file Federal tax returns. To date, co-ops have been limited in the ways they could finance renewable energy projects, including storage projects. They have had to primarily seek out expensive tax equity in order to finance these types of clean energy projects in the past.

With direct pay, any co-op that wants to do a renewable energy and/or energy storage project can directly visit the CFC for traditional financing, and then have a check cut by the Department of Treasury. It’s a very simple, clean, easy way for co-ops to access financing. This provision alone could be a game changer and truly catalyze the storage market. The one caveat to the simplicity of this option is unlike electing the ITC where domestic content is a 10% adder, if electing direct pay then sourcing domestic content is a requirement. That is a key difference between these two options. The bottom line is passage of the BBB will remove key financing barriers that previously made it more difficult for co-ops, municipalities, and other tax exempt entities to cost effectively build new projects.

The Reconciliation Bill’s Broader Impact on Co-op Storage Projects

Matt Smith of GDS Associates—a multi-service consulting firm with roots in power supply and providing consulting services to co-ops for power supply planning needs—presented on what the ITC means for energy storage installation costs and clean energy goals.

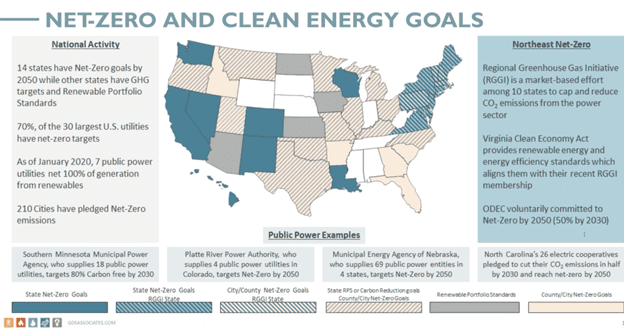

The proposed ITC seeks to reduce the cost of energy storage ownership while additional federal funding will support driving down technology costs, which in turn will decrease installation costs. The federal government has billions of dollars earmarked for technology investment related to energy storage. This helps create a roadmap for clean energy goals across the country as seen in the figure below.

Net-zero and clean energy goals drive the need to install new standalone energy storage sites. Installation costs have been dropping and are expected to continue to decline for the next 10 years. How much these installation costs will decline is dependent on economies of scale and if the site has 10, 4, or 2 hour duration batteries. If the BBB is passed, then installation costs are expected to reach a goal of less than $100/kWh in 2022 due to the government’s continued investment in energy research & development.

Learn more about Stem’s solutions for electric co-ops and the Federal Storage ITC

For more details on each of these topics and to listen to the Q&A, you can view the on-demand webinar here.