Today, sustainability is not a choice but a necessity. Stakeholders in global businesses – including investors, customers, and employees – demand that corporate responsibility in environmental, social, and governance (ESG) practices be integrated, connected, and transparent. According to Centre of Audit Quality (CAQ), a record 98% of S&P 500 companies have published sustainability reports, reflecting the growing emphasis on ESG reporting. The State of U.S. Sustainability examined 250 sustainability reports from S&P 500 companies and found that sustainability reporting is increasingly being shaped by regulatory requirements for more ESG disclosures.

This blog delves into the key takeaways from Stem’s first ESG Report and explores broader trends in ESG reporting.

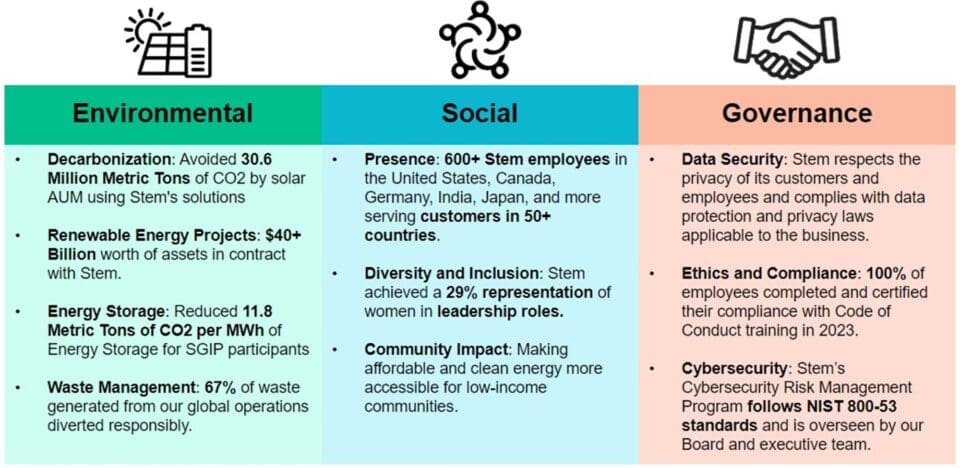

Highlights from Stem’s ESG Report

Stem’s inaugural ESG Report underscores that our growth and evolution are not just about expanding our business but also about playing a crucial role in driving decarbonization at pace and scale. Our own analysis has shown that our solutions and services have helped avoid approximately 30.6 million metric tonnes of carbon dioxide emissions across solar assets under management in 2023. To put this into perspective, that’s roughly equivalent, per the EPA’s conversion calculator, to the annual emissions of over 7.2 million gas-powered passenger vehicles or emissions from over 80 natural gas-fired power plants.

Balancing energy needs with developmental goals is essential, and Stem is at the forefront of this mission. Our AI-enabled software and services expertise helps to make the renewable energy sector more accessible and aims to be more profitable for our customers. Stem manages 5+ GWh of storage and 25+ GW of solar assets worldwide for more than 16,000 customers today. The transformative power of our AI-enabled software and services is driving solutions for one of the biggest challenges facing humanity today: climate change.

Here are a few highlights that show Stem’s recent achievements across ESG domains:

Broader Trends in ESG Reporting

Stem’s efforts are part of larger trends in ESG reporting. Let’s explore what’s driving this growth.

Regulatory Scrutiny and Transparency

A significant development is the increasing regulatory scrutiny and demand for transparency in ESG disclosures. Governments and regulatory bodies worldwide are implementing stricter requirements, pushing companies to provide more detailed and comparable ESG data. As of 2023, several countries have implemented mandatory ESG reporting requirements, including Brazil, the European Union, Hong Kong, Japan, New Zealand, Singapore, Switzerland, and the United Kingdom. Additionally, countries like Australia, Canada, Chile, Colombia, India, and the United States have either passed or proposed new ESG regulations last year. This growing list reflects the increasing global emphasis on transparency and accountability in corporate sustainability practices.

Established ESG Frameworks

The CAQ report highlights the increasing use of established ESG frameworks such as the Sustainability Accounting Standards Board (SASB) Standards, Global Reporting Initiative (GRI) Standards, and Task Force on Climate-Related Financial Disclosures (TCFD) Recommendations. These frameworks provide a standardized approach to ESG reporting, enhancing comparability and transparency.

Data Accuracy

While the rise in ESG reporting is encouraging, the accuracy of reported data remains a critical challenge. A study by S&P Global Sustainable found that 16% of companies made errors in Scope 1 GHG emissions data and 13% made errors in Scope 2 data. These errors can originate from partial disclosures or misalignment with the GHG Protocol standard.

The Evolution of ESG at Stem

Stem strongly believes that data accuracy is essential for meaningful ESG reporting. We worked with reputable partners to assure that our organizational boundary definitions and associated data collection comports with globally accepted standards for Scope 1, 2, and 3 emissions reporting. We engaged Green Project as our carbon accounting partner to perform our corporate GHG emissions calculations using a globally accepted standard, GHG Protocol. We also engaged Novisto as our sustainability metrics partner to help align our data with SASB industry-specific standards and the TCFD framework. Our stakeholders – including employees, partners, customers, and suppliers – all contributed to our Report by providing important feedback.

Stem also aligns our business efforts with the following nine UN Sustainable Development Goals:

Going Forward

Stem’s ESG Report exemplifies our dedication to operating a complex global enterprise sustainability. By aligning with globally recognized ESG frameworks and continuously improving our emissions reporting, we aim to continue to mature our ability to be transparent to all our stakeholders.

Click here to read Stem’s ESG Report.